이미지 확대보기

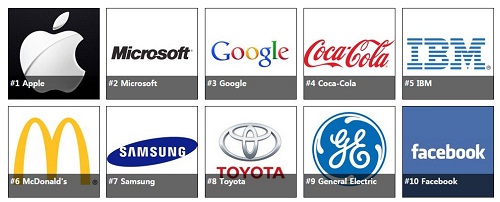

이미지 확대보기포브스는 14일 ‘The World's Most Valuable Brands’란 이름으로 브랜드 가치가 높은 세계 100대 기업을 발표하면서 삼성전자를 세계 7위에 올렸다.

브랜드 가치란 기본적으로 숫자로 계량화하기 어려운 것이다.

포브스가 나름의 기준을 세우고 그 기준에 따라 스스로 서열을 매긴 것에 지나지 않는다.

그 애매한 기준으로 줄을 세우면서도 마치 확정적인 것인 양 보도하는 포브스의 태도부터가 문제이다.

기업 서열을 공개하려면 우선 평가기준에 대한 충분한 공감대를 얻어야 한다.

또 사후적으로도 평가의 기준과 방법을 매우 소상하게 밝혀야 하는 것이 기본이다.

포브스는 그러나 공감대를 구하는 절차를 전혀 밟지 않았다.

조사방법론에 대한 설명에도 그리 많은 비중을 두지 않았다.

책임있는 언론으로서는 미흡한 대목이 없지 않은 것이다.

참으로 가관인 것은 기사의 내용이다.

Kurt Badenhausen기자는 기업별 브랜드 순위를 언급하면서 느닷없이 기업가치와는 무관한 광고비를 문제 삼았다.

그는 이 기사에서 삼성전자가 소비자들을 움직이기 위해 근 40억 달러의 광고비를 지출한 반면 애플은 지난해 삼성전자의 3분의 1인 12억 달러만을 광고비로 지불했다고 보도했다.

(While Samsung spends nearly $4 billion on advertising to sway consumers, Apple spent only one-third as much at $1.2 billion last year.)

Kurt Badenhausen기자는 여기서 한 걸음 더 나아가 애플은 상품을 팔기위해 메디슨가 보다는 팬 기반에 의존한다고 밝혔다.

(The company relies on its avid fan base more than Madison Avenue to promote its products.)

메디슨 가는 뉴욕의 광고거리로 곧 광고를 의미한다.

이 기자의 글은 전후 상황과 문맥으로 미루어 “삼성전자는 애플보다 팬의 기반이 약해 광고에 의존할 수 밖에 없다”는 것으로 해석될 여지가 다분하다.

기자가 어떤 기업을 더 좋아하는 것은 개인의 자유일 것이다.

다만 그 사랑을 기사로 표현할 때는 객관성에 근거해야 한다.

그래야 기자이고 언론이다.

기업이 광고를 하는 데에는 여러 가지 이유가 있을 수 있다.

단순히 광고비가 많다는 이유만으로 팬 기반이 약하다고 단정하는 것은 편견일 뿐이다.

팬의 성원에 보답하는 광고도 있다.

신제품 개발이 잦으면 팬들에게 더 많이 알려야 할 것이다.

이런 식으로 기사를 쓰면 포브스의 기업순위발표의 공신력은 추락할 수밖에 없다.

포브스가 발표하는 수많은 순위가 장삿속으로 추진된 것이라는 오명에 빠지지 않았으면 한다.

이미지 확대보기

이미지 확대보기[다음은 포브스 기사 전문]

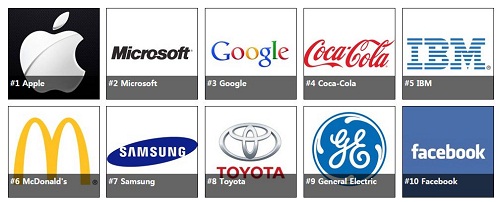

Apple And Microsoft Head The World's Most Valuable Brands 2015

Kurt Badenhausen

FORBES STAFF

I cover sports business with rare dip in education & local economies FULL BIO

Leadership changes are challenging. They can be even tougher when an iconic company founder is replaced. Nike and Starbucks both stumbled after Phil Knight and Howard Schultz stepped down from leading their respective companies. Steve Jobs was ousted from Apple in 1985 and the company entered a near death spiral in the early 1990s. But Jobs returned in 1996 to lead the company to unprecedented heights. In Apple’s latest transition, the train keeps on rolling under CEO Tim Cook, who replaced Jobs in 2011. “The brand promise with Apple is so strong and they continue to deliver on that,” says Kevin Lane Keller, a branding expert and professor at Dartmouth’s Tuck School of Business.

The Apple brand is now worth $145.3 billion by our count, up 17% over 2014. The brand ranks on top of Forbes’ list of the World’s Most Valuable Brands for a fifth straight time and is worth twice as much as any other brand on the planet. The company sold 74.8 million smartphones worldwide in the fourth quarter of 2014 with phone sales up 49%. It was the first quarter Apple sold more phones than Samsung since 2011 (Samsung regained its No. 1 position in the first quarter of 2015). Apple is making money hand over fist with an $18 billion profit in the fourth quarter, up 33% from the prior year.

While Samsung spends nearly $4 billion on advertising to sway consumers, Apple spent only one-third as much at $1.2 billion last year. The company relies on its avid fan base more than Madison Avenue to promote its products.

Apple revolutionized four industries over the past 15 years with the launch of the iPhone, iPad, iPod and iTunes. Its next target is watches. The Apple Watch launched in April. Forecasts for first year sales are all over the map and typically range between eight million and 15 million. Analysts at Piper Jaffrey expect watches to represent 10% of Apple’s 2017 revenue. Keller is skeptical of the potential of the Watch, but recognizes the incredible track record Apple has to produce great products. “If the watch turns out to be a success, it is going to fuel the company and brand even more,” says Keller.

Microsoft ranks as the second most valuable brand worth $69.3 billion, up 10%. After years of getting beaten up in the press and by users, the $94-billion-in-sales company is suddenly cool again under CEO Satya Nadella, just the company’s third leader in 40 years. The company is intriguing developers and introducing captivating products like its HoloLens, a headset which brings hi-def holograms to life using Windows. “We want to move from people needing Windows to choosing Windows, to loving Windows. That is our bold goal,” said Nadella at the Windows 10 launch event in January.

The company poured $11 billion into research and development last year. Windows 10 will be released this summer and is expected to be the last major release of the venerable operating system. Future updates will be in an “ongoing manner.” The company wants one billion Windows 10 users by 2018.

Microsoft is no longer the 800-pound gorilla in the tech space, which has softened some of the criticism, but Keller is looking for consumers to want to engage with the brand before he labels it cool again. “I can see why people have stopped hating them, but can’t see why people would start loving them,” says Keller.

Rounding out the top five are Google ($65.6 billion), Coca-Cola ($56 billion) and IBM ($49.8 billion).

We determined the most valuable brands by starting with a universe of more than 200 global brands. We required brands to have at least some presence in the U.S., which knocked out big brands like Chinese internet giant Tencent and multinational telecom firm Vodafone. The top 100 includes product brands like Procter & Gamble-owned Gillette as well as brands marketed under their corporate name like IBM.

Forbes valued these brands on three years of earnings and allocated a percentage of those earnings based on the role brands play in each industry (e.g., high for luxury goods and beverages, low for airlines and oil companies). We applied the average price-to-earnings multiple over the past three years to these earnings to arrive at the final brand value (click here for the full methodology).

The 100 most valuable brands span 15 countries across 20 broad industry categories. Brands from U.S.-based companies make up just over half the list with the next biggest representation from Germany (9 brands), Japan (7) and France (7). Tech brands are the most prevalent with 15, including half of the top 20. Automotive and consumer packaged goods companies both landed 13 brands within the top 100. Toyota was the top auto brand at No. 8, worth $37.8 billion, while Gillette headed the CPG brands at No. 26, worth $20.4 billion.

Facebook registered the biggest gain of any brand in the top 100, up 54%. It cracks the top 10 for the first time with value of $36.5 billion. Facebook had 936 million active daily users as of March 2015 with 83% of those outside the U.S. The brand has emerged as a competitor to YouTube regarding video. In April the company reported that it delivered four billion video views daily compared to one billion just seven months earlier. Other big gainers in the top 100 include: Amazon.com (+32%) and Disney (+26%). Adidas (-14%) and Danone (-13%) had the biggest drops.

김대호 연구소 소장 /경제학 박사 tiger8280@

![[초점] 아마존, 창고 로봇 100만 대 넘어…사람과 '동료'에서 '경...](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=80&h=60&m=1&simg=2025070119212508076fbbec65dfb1161228193.jpg)